Mortgage lending reflects stable UK property market

The Council of Mortgage Lenders in the UK has released the November 2016 statistics on borrowings by home-buyers and the data reveals that the housing market remains stable. In fact, the mortgage activity is 5 percent up sequentially throughout October 2016, increasing marginally by 2 percent for the corresponding period in 2015.

The statistics on mortgage activity in the UK is a clear sign of the housing market continuing to demonstrate growth following a brief stagnation in the wake of Brexit. It shows that homeowners borrowed £11bn for their house purchase during November 2016 equating to 60,800 loan approvals.

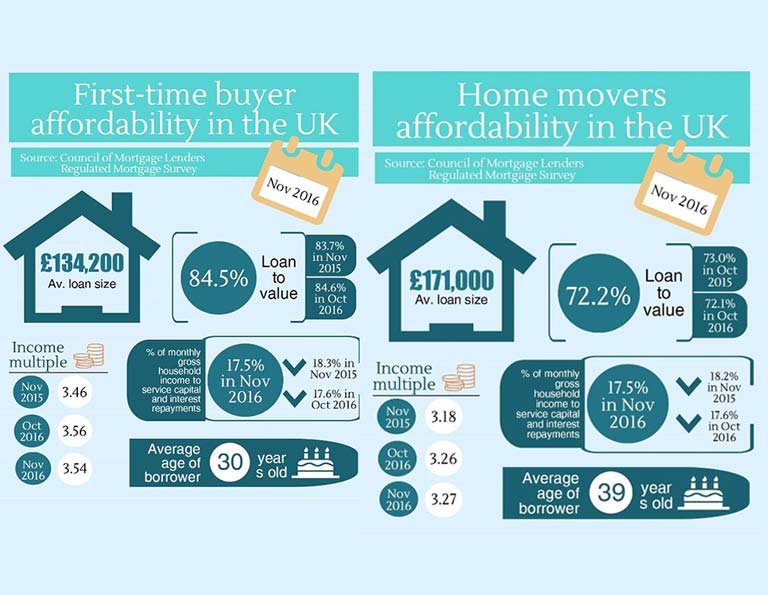

Interestingly, first-time homebuyers borrowed £4.7bn, an increase of 4 percent in October and 9 percent in November 2015. This growth also signifies the role of first-time homebuyers in boosting the demand for quality homes in the UK. The typical loan size of the first-time homebuyers was £134,200 while their average household income was £40,200.

The combined mortgage activity shows that the demand for housing in the UK continues to outstrip supply. Incidentally, the gross buy-to-let lending in November saw the highest monthly level increase since the stamp duty changes on second properties introduced in April. The CML data revealed that over two-thirds of the buy-to-let loans were remortgages rather than new house purchases.

The statistics and market projections given by the CML provide a detailed insight into the housing market of the UK. The CML’s members are banks, building societies and other lenders who together undertake around 97 percent of all residential mortgage lending in the UK. There are 11.1 million mortgages in the UK, with loans worth over £1.3 trillion.

CML Director General Paul Smee has stated that the economic activity will impact the housing market this year. He said the CML expected 1.2m transactions in 2017 with gross lending to reach around £248 bn. It means that the housing market will indeed remain stable.

None can dispute the fact that Brexit had an impact to an extent on all core sectors of the economy, but the recovery of the property market was quick. This reflects the strong fundamentals of the UK property market, which offers one of the best ROI and increase in capital values for investors.

Strawberry Star offers end-to-end services in the UK real estate market. As one-stop destination for investors in the London property market, we assure the best of services, which also include advisory on mortgage options. If you are interested in acquiring a buy-to-let property in London, connect with our estate agents from any of our global offices.

Source: cml.org.uk

Image: CML.Org.uk